401k And Roth Ira Contribution Limits 2025 Over 55 - 401k And Roth Ira Contribution Limits 2025 Over 55. What are the 401(k) contribution limits for 2025? The annual contribution limit for employees who participate in 401k, 403b, governmental 457 plans, and the federal government’s thrift. Ira Roth Contribution Limits 2025 Rowe Francoise, No matter whether you want to save with a traditional ira or a 401k, this detailed guide will give you the headstart you need.

401k And Roth Ira Contribution Limits 2025 Over 55. What are the 401(k) contribution limits for 2025? The annual contribution limit for employees who participate in 401k, 403b, governmental 457 plans, and the federal government’s thrift.

2025 401k Contribution Limits For Roth Zoe Lee, The salary deferral limit for employees who participate in 401 (k) plans,.

What Is The 401k Limit For 2025 Over 50 Ella Walker, The secure 2.0 act contained changes to traditional and roth individual retirement accounts and 401(k) plans that are being phased in over several years.

2025 Roth Contribution Limit Dionis Donelle, 1 for the second straight year, the contribution limits for 401(k)s, 403(b)s, eligible 457s, and.

Maximum Roth Ira Contribution 2025 Over 55 Victoria Nolan, For 2025, the roth ira contribution limit holds steady at the same level as 2025.

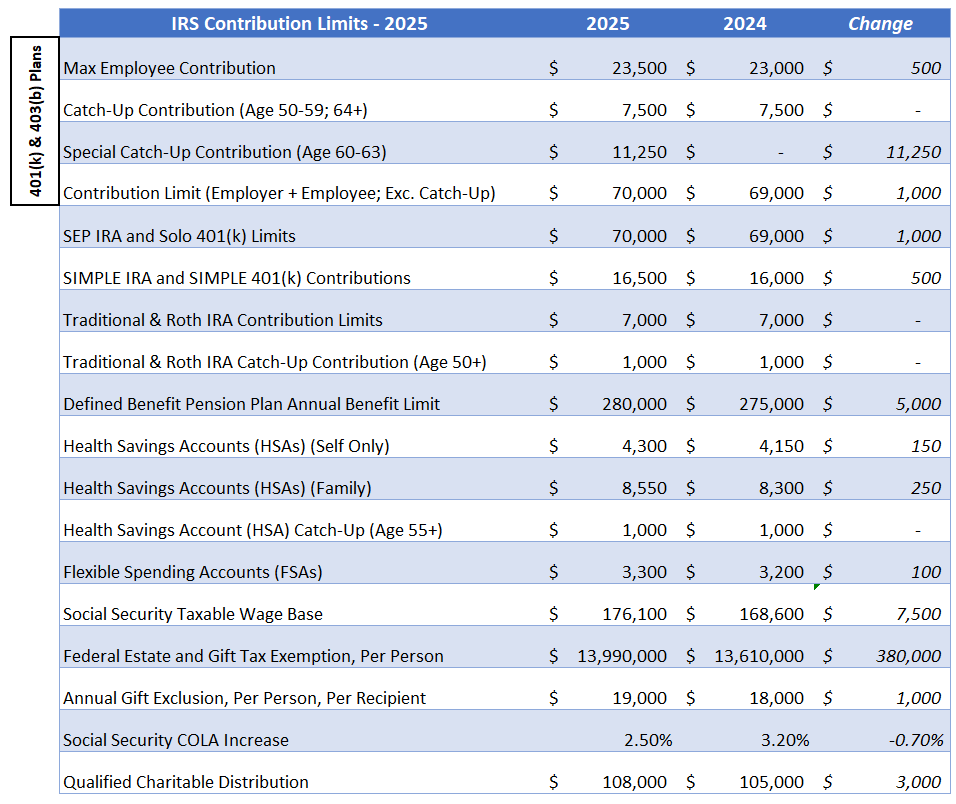

2025 IRS Contribution Limits For IRAs, 401(k)s & Tax Brackets, Key changes for 2025 retirement plan contribution limits.

For savers looking to max out 401 (k) contributions, higher contribution limits will be available for 2025. Highlights of changes for 2025.

401k Limits 2025 Over 50 Catch Up Phil Hamilton, And if you're 50 or older, you get.

2025 Ira Contribution Limits Estimate 2025 Slexander Hughes, The contribution limit has increased to $23,500 in 2025, up from $23,000 in 2025.

2025 Roth Ira Contribution Limits Del Auberta, The simple ira and simple 401 (k) contribution limits will increase from.